The mere point out of the phrases “oil” and “gasoline” conjure up pictures of Texas for many Individuals, and Alberta for Canadians – fingers down, the 2 most crucial hydrocarbons hotspots in North America. However with a weak This fall market outlook in Texas and a serious exodus of oil and gasoline corporations from Alberta, it’s completely doable that these two venues might lose their declare to the fossil fuels throne within the coming years.

Any solutions to what would possibly substitute them are invariably discovered within the ominous rig depend.

Rigs on the bottom inform a way more detailed story in regards to the state of affairs in each Texas and Alberta. And rigs are the most important indications of the way forward for every thing within the trade from jobs to chapter.

There’s rather a lot using on rigs, which is precisely why merchants are obsessive about the Baker Hughes rig depend that comes out each Friday. It’s additionally why they need to be extra obsessive about this than with the U.S. stock figures that flip buying and selling right into a sideshow of inaccurate numbers and misunderstandings.

For rigs, the depend is evident, and so are the implications.

Is the Falling Rig Rely in Texas a Signal of Issues to Come?

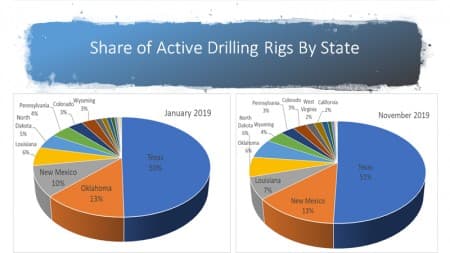

At the start of 2019, Texas single-handedly accounted for 534 of the 1,075 oil and gasoline rigs working in america, housing almost 50% of all energetic oil and gasoline rigs within the US. The three states that had the most important variety of energetic rigs – Oklahoma, New Mexico, and Texas – collectively held almost three quarters of all energetic rigs at 72.5%.

However issues have shifted for the reason that begin of the 12 months. Texas’ absolute rig depend has dipped from 534 to 416. Nonetheless, it fared higher than many different states, and its share of all energetic rigs in america has elevated.

The Lonestar state now holds greater than 50% of all energetic rigs in america. Associated: The Rig Rely Collapse Is Far From Over

In the meantime, the Large three – or what was the Large three – have misplaced some floor, and now maintain lower than 70% of all of the US rigs, with Oklahoma shedding 65% of its rigs 12 months over 12 months and giving up its No. three spot to Louisiana.

Even because the variety of energetic rigs in Texas have fallen over the course of 2019, Texas continues to be the primary oil producer, and it’s nonetheless dwelling to the best variety of oil and gasoline jobs within the nation.

However a phrase of warning: from September 2018 to September 2019, the oil and gasoline trade in Texas added simply 1,700 positions – the smallest variety of positions added to any trade in Texas. This slowing of latest oil and gasoline jobs is carefully tied to the decreases to its absolute rig depend – at the same time as it’s rising manufacturing.

The cash backing the oil and gasoline trade is not happy with mere will increase in manufacturing – no, they need revenue. And revenue in in the present day’s risky oil market comes by way of belt tightening – and one of many notches on that belt is labor prices. Those that are unable to seek out methods to cinch that belt have been pressured out of business – and Texas has seen 27 bankruptcies within the oil and gasoline trade since Could.

This fall isn’t wanting a lot brighter, with Halliburton and Schlumberger – the 2 largest US-based oilfield companies supplies – anticipating much more of a slowdown in buyer exercise than what we’ve seen this 12 months.

However all just isn’t misplaced. Whereas oil and gasoline extraction-related jobs in Texas have seen a pointy decline for the reason that increase of 2014, they’re now as soon as once more on the rise – a average rise – even because the variety of rigs falls off.

Texas’ Canadian Cousin

Canada’s Alberta province – answerable for holding 70% of all Canadian oil and gasoline rigs – has by no means confronted more durable instances. It has weathered mounting environmental pressures from different Canadian provinces that has stymied trade development as important pipeline tasks flounder in regulatory and political purgatory. Within the runup to 2019, Alberta’s Premier Rachel Notley instituted a compulsory oil manufacturing quota for the province, taking 325,000 bpd off the market in an effort to buoy the value of its benchmark Western Canadian Choose, which was buying and selling at a steep low cost to WTI.

And its variety of energetic rigs has mirrored these robust instances.

The province’s Four-week common oil and gasoline rig depend at the beginning of the 12 months was 120 rigs. At the moment, this determine is 97, for a 19% lower in energetic rigs.

Consequently, Alberta has hemorrhaged oil and gasoline jobs in 2019, with unemployment of younger males in Alberta now at 19.9% – a rise of Four% from only one month in the past. And it has additionally began to hemorrhage total corporations.

In 2019, Kinder Morgan divested the final of its holdings in Canada, and its most up-to-date loss – in November – was that of Calgary-based Houston Oil & Gasoline Ltd, which had operated 1,200 wells in Alberta – now they’ve none. The week earlier than that, Encana introduced that it might relocate from Calgary to america. Associated: The Science Behind Darkish Power

After this robust 2019, issues could search for for Alberta. On Friday, these manufacturing quotas had been eased for brand new typical wells – a transfer that ought to encourage new drilling as corporations attempt to make up for misplaced floor stemming from the quotas. And quotas had already been eased within the week prior for corporations who had been delivery their oil by rail.

However lifting manufacturing quotas won’t assist Canadian oil corporations ship their product overseas.

Why the Rig Rely Metric

No matter what ails the oil trade, there are a sequence of metrics that merchants and buyers use to evaluate the state of the trade – whether or not you’re inquisitive about Canada or america. Baker Hughes rig depend is only one of them – however control this depend.

In in the present day’s data-driven world, it’s laborious to fathom how oil and gasoline information – be it stock information, delivery information, rig information, DUC nicely information, and manufacturing information – is something lower than correct, however a lot of that information is much less correct than most individuals imagine.

Working example: simply two weeks in the past, the API provided stock figures as standard, and Twitter customers rapidly disseminated the knowledge. However there was an issue. Someday later – and we’re unsure how a lot later – the API despatched out a second, corrected set of figures to its paid subscribers. A second set of figures unfold by way of Twitter, after which by way of the media. Armed with two units of knowledge, the markets had been confused. The next morning, the EIA printed their very own information, offering but a 3rd image of how stock moved for the week. This information is nice for predicting short-term worth swings.

If you wish to hold your finger on what is occurring with oil and gasoline producers, the BH rig depend is tied to what they’re really doing.

What occurs subsequent in Texas and Alberta isn’t going to return right down to wild numbers popping out of the API. If you wish to commerce on the way forward for Texas and Alberta, hold your eye on the rig counts and even the labor figures.

Proper now, this throne is probably up for grabs sooner or later.

By Julianne Geiger for Oilprice.com

Extra Prime Reads From Oilprice.com:

source https://cvrnewsdirect.com/the-most-important-data-point-in-u-s-oil-markets/

No comments:

Post a Comment