- Slowing wages’ progress has already harm Aussie, little the employment report can do.

- Australian job’s creation seen moderated in October.

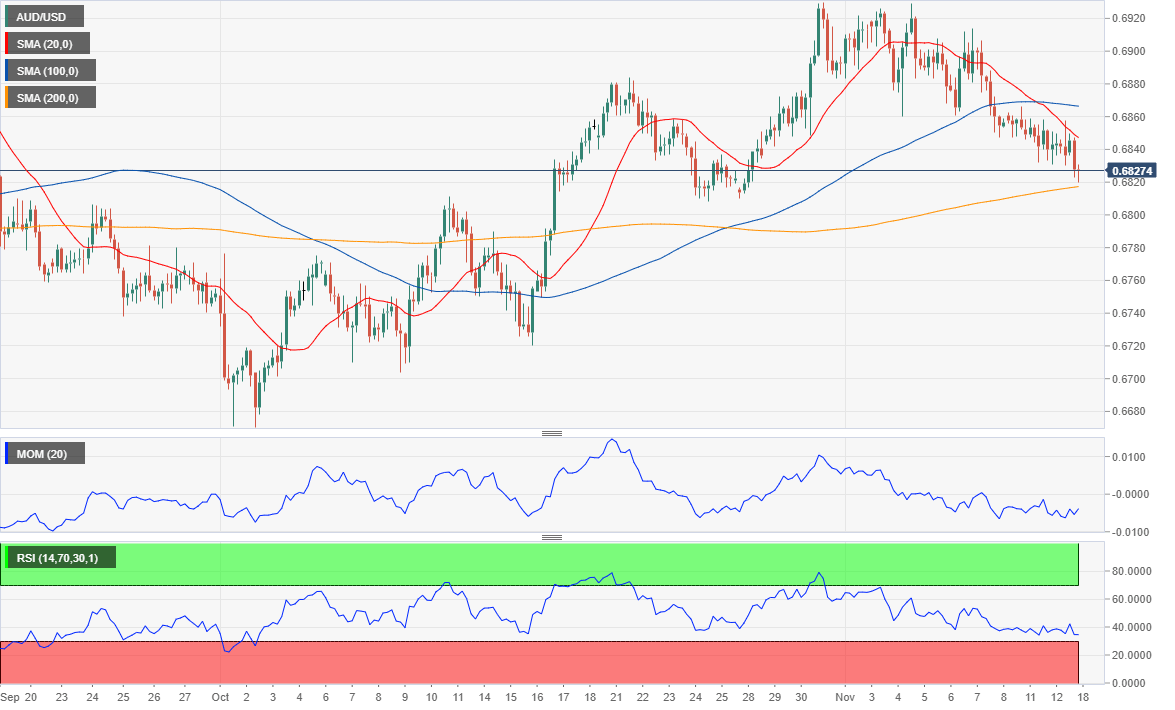

- AUD/USD liable to extending its decline towards zero.6670.

Australia will launch this Thursday its October employment knowledge. The economic system is anticipated to have added 15.0K new jobs within the month, following a 14.7K improve in September. The unemployment charge is anticipated to tick larger to five.three%, regardless of the participation charge is foreseen regular at 66.1%.

In September, the nation added 26.2K full-time positions, whereas part-time jobs decreased by 11.4K. The composition of the headline determine can also be related because the extra full-time jobs, the higher is for the economic system.

Wages’ progress beneath pattern for over seven years

Forward of the occasion, nonetheless, the Australian Bureau of Statistics launched the Q3 Wage Worth Index, which was up within the quarter by zero.53%, assembly the market’s expectations. When in comparison with a yr earlier, it was up by 2.2%, beneath the earlier 2.three% and in addition lacking the market’s forecast. These numbers confirmed that wages are stagnated beneath the long-term progress charge of three.2%, a stage seen over seven years in the past.

Regardless of the result’s of the roles’ report, the sluggish wages’ progress ought to preserve the RBA within the easing path. If the numbers disappoint, stress on policymakers will mount. RBA’s Governor Lowe signalled a pause within the easing cycle earlier this month, and speculative curiosity believes that the RBA is completed for this yr, notably contemplating reducing charges could backfire and dent consumption.

AUD/USD potential eventualities

The employment report would possible set off some motion in AUD/USD, largely if the numbers diverge from the market’s expectations. A greater-than-expected report might assist the Aussie advance, though, given its bearish pattern, the motion will possible be short-lived, with sellers ready at larger ranges. Worse-than-anticipated figures, then again, would exacerbate the dominant bearish pattern.

Conclusion

Because it has been occurring in the previous few months, except the ultimate numbers put up a large divergence with the market’s forecasts, the report may have a restricted impact on the Australian greenback, with extra probabilities of a bearish run within the case the report misses, than of a rally within the case it surprises to the upside.

source https://cvrnewsdirect.com/little-can-change-rbas-dovish-stance/

No comments:

Post a Comment